fintechzoom QQQ stock. Also known as the Invesco QQQ Trust, represents one of the most widely traded exchange-traded funds (ETFs) on the market today. It is designed to track the performance of the NASDAQ-100 Index. Which includes 100 of the largest non-financial companies listed on the NASDAQ stock exchange. QQQ is renowned for its focus on technology and growth-oriented stocks. Making it a popular choice among investors seeking exposure to innovative sectors.

Technological Innovation

The success of QQQ is closely tied to the rapid pace of technological innovation. Companies within its portfolio are at the forefront of developing groundbreaking technologies. From artificial intelligence and cloud computing to e-commerce and digital payments. Investors view QQQ as a way to capitalize on these transformative trends shaping the global economy.

QQQ’s performance can also be influenced by broader market dynamics and sector rotations. During periods of economic expansion or specific sector booms (like software or biotechnology). QQQ may see heightened investor interest and price appreciation. Conversely, economic downturns or shifts in investor sentiment towards specific sectors can impact its performance negatively.

Global Economic Conditions

Global economic conditions play a pivotal role in shaping investor sentiment towards QQQ. As a globally diversified ETF, it is exposed not only to U.S. market conditions but also to international economic trends. Factors such as trade policies, currency fluctuations, and geopolitical events can impact the fund’s performance and investor confidence.

Investors often debate whether growth-oriented ETFs like QQQ are more suitable than value-oriented alternatives, especially during market cycles favoring one style over the other. QQQ’s focus on growth stocks implies the potential for higher returns but also heightened volatility compared to value-oriented investments.

Volatility and Risk Management

Due to its concentration in technology and growth stocks, fintechzoom qqq stock can experience periods of heightened volatility. Investors should assess their risk tolerance and consider diversifying their portfolios with assets that offer stability during market downturns.

Like all ETFs, fintechzoom qqq stockcharges an expense ratio for fund management and operational costs. Investors should compare these fees with other similar ETFs and consider their impact on overall investment returns over the long term.

In the realm of exchange-traded funds (ETFs), few have garnered as much attention and acclaim as the QQQ, often referred to simply as “QQQ.” This ETF, managed by Invesco, tracks the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market. The QQQ ETF is renowned for its focus on technology and growth stocks, making it a favorite among investors seeking exposure to some of the most innovative and dynamic companies in the market today.

What is QQQ?

The QQQ ETF was first launched in 1999 and has since become one of the most actively traded ETFs in the world. Its popularity stems from its unique composition, which includes leading companies across various sectors such as technology, consumer discretionary, healthcare, and communication services. Some of its top holdings include tech giants like Apple Inc. (AAPL), Microsoft Corporation (MSFT), and Amazon.com Inc. (AMZN), among others fintechzoom qqq stock.

Investment Strategy and Performance

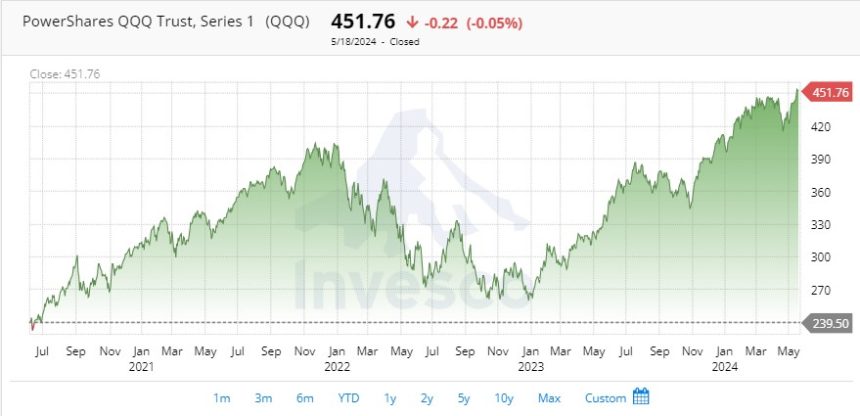

Investing in QQQ offers investors a way to gain diversified exposure to the growth potential of the largest companies listed on the Nasdaq. The ETF’s portfolio weights heavily towards the largest companies within the Nasdaq-100 Index, thus reflecting the performance of the technology sector

Over the years, QQQ has delivered impressive returns, outperforming many other ETFs and indices. Its performance closely ties to the fortunes of the tech sector, which has driven stock market gains significantly in recent decades However, it’s important to note that this focus on high-growth stocks also comes with increased volatility, as tech stocks can experience significant price swings from fintechzoom qqq stock.

Key Benefits and Risks

Benefits:

Diversification: QQQ offers exposure to a wide range of leading tech and growth stocks, reducing individual company risk.

Liquidity: As one of the most actively traded ETFs, QQQ typically has high liquidity, making it easy to buy and sell shares.

Potential for Growth: Investing in QQQ allows investors to capitalize on the growth potential of some of the most innovative companies in the world.

Risks:

Volatility: The tech-heavy nature of QQQ means it can be more volatile than broader market indices.

Concentration Risk: Since QQQ focuses on a limited number of sectors and companies, it may not be suitable for investors seeking broad market exposure.

Sector-Specific Risks: Changes in technology trends or regulatory actions can significantly impact the performance of QQQ.

Should You Invest in QQQ?

Deciding whether to invest in QQQ depends on your investment goals, risk tolerance, and portfolio diversification strategy. For investors bullish on the long-term growth prospects of the technology sector, QQQ can be an attractive option. It provides exposure to some of the most successful and innovative companies in the world, offering the potential for significant capital appreciation over time.

However, prospective investors should carefully consider the risks associated with fintechzoom qqq stock, including its volatility and sector concentration. It may be prudent to consult with a financial advisor to determine whether QQQ aligns with your investment objectives and risk profile.

Conclusion

QQQ remains a cornerstone ETF for investors seeking exposure to leading technology and growth companies listed on the NASDAQ.Technological innovation, market dynamics, and global economic conditions drive its performance. Understanding these factors can help investors make informed decisions about including QQQ in their investment portfolios, and balancing growth opportunities with associated risks in today’s dynamic market environment.

FAQs about Q stock:

Q1. What is QQQ stock?

QQQ, or the Invesco fintech zoom qqq stock Trust, is an exchange-traded fund (ETF) that tracks the NASDAQ-100 Index, comprising 100 of the largest non-financial companies listed on the NASDAQ stock exchange.

Q2. Why invest in QQQ?

Investors choose QQQ for its exposure to high-growth sectors like technology and innovation, which have historically shown strong performance and potential for future growth.

Q3. What are the risks of investing in QQQ?

QQQ’s focus on technology and growth stocks exposes investors to higher volatility compared to more diversified or value-oriented investments. Economic downturns and sector-specific challenges can impact its performance.

Q4. How does QQQ compare to other ETFs?

Compared to other ETFs, QQQ stands out for its concentration in technology and growth stocks, offering the potential for higher returns but also carrying higher risks. Investors should consider their risk tolerance and investment goals when choosing between ETF options.